Examining the Sufficiency of Private Pension Fund in Malaysia using Monte Carlo Simulation

DOI:

https://doi.org/10.37934/sijfam.1.3848Keywords:

Pension sufficiency, income group, simulation, uncertainty, inflationAbstract

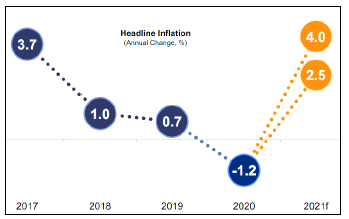

Retirees must make wise plans to have enough savings in order to continue living at the same level after retirement. Retirement planning is essential for ensuring enough retirement funds, which give Malaysians elderlies with a source of income to maintain their standard of living and keep them out of poverty. Uncertainties in dividend rates, interest rates, and inflation have made it difficult for Malaysia's private pension system, notably the Employee Provident Fund (EPF) scheme, to stay financially viable and capable of offering pensioners adequate protection. Thus, this study takes into consideration these important factors in analyzing the sufficiency of the private pension fund in Malaysia for different income groups namely top 20% of income earners (T20), middle 40% income earners (M40) and bottom 40% income earners (B40). Several scenarios are prepared according to Malaysian’s norm to examine the sufficiency of pension fund for each income group. The differences among the scenarios are income groups, retirement age and number of pension fund withdrawals. Then, the Monte Carlo simulation is run to calculate the accumulated value of the pension fund. Following that, the estimated monthly pension amount and the income replacement ratio are calculated to measure pension sufficiency. The results show that the income replacement ratio on average is significantly lower for all income groups as compared to the World Bank standard which stated that the income replacement ratio should not be below 70%. The results also show similar ratio with the current income replacement ratio recorded in Malaysia currently. When the number of withdrawals is taken into consideration, the income replacement ratios on average also show a decreasing pattern for all income groups. These findings indicate that the income replacement ratio in Malaysia is below the ideal rate and the pension amount is not sufficient to maintain the standard of living and purchasing power of retirees. Therefore, the government should take some action regarding this problem focusing on the B40 income group on how to increase their pension fund for better quality of life during retirement and avoid poverty.

Downloads