An Active Cyber Insurance Policy Against Cybersecurity Risks Using Fuzzy Q-Learning

DOI:

https://doi.org/10.37934/araset.30.3.212221Keywords:

Cyber Insurance, Cyber Risks, Cybersecurity, Fuzzy, Reinforcement Learning, Autonomous ComputingAbstract

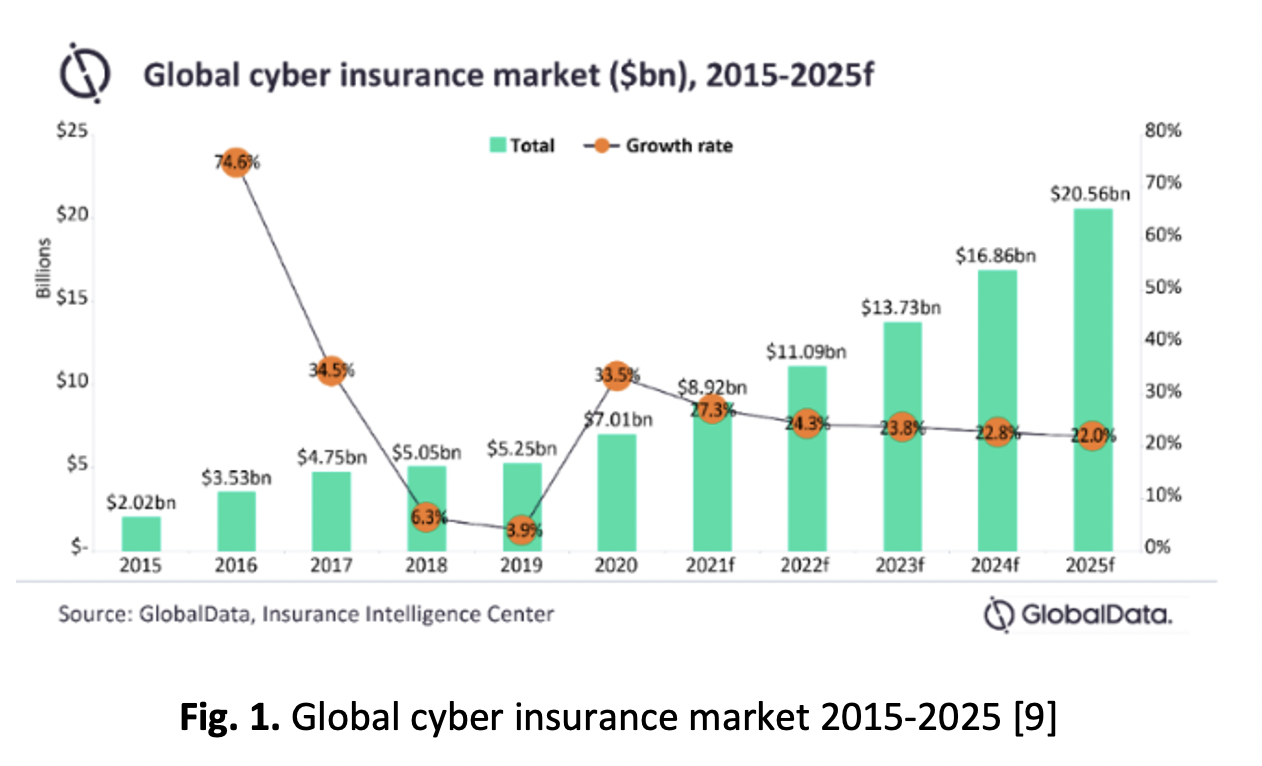

Insurance is an extremely diversified from one clear-cut policy to another depending on a rising demand. Internet based businesses are a booming industry and falls under categories of small, medium and enterprise. It is no exception that cybersecurity risks are exponentially presents as a continues fears in this business environment. To ensure this insecurity is handled effectively, cyber insurance policies introduced by insurance companies. However, the nature of cyber risks must be addressed in much more robust and complex algorithms. Autonomic computing with the combination of Fuzzy and Q-Learning is introduced to ensure active policies are ready to handle the uncertainty and together with the ability to learn and mitigate the unrest situation.