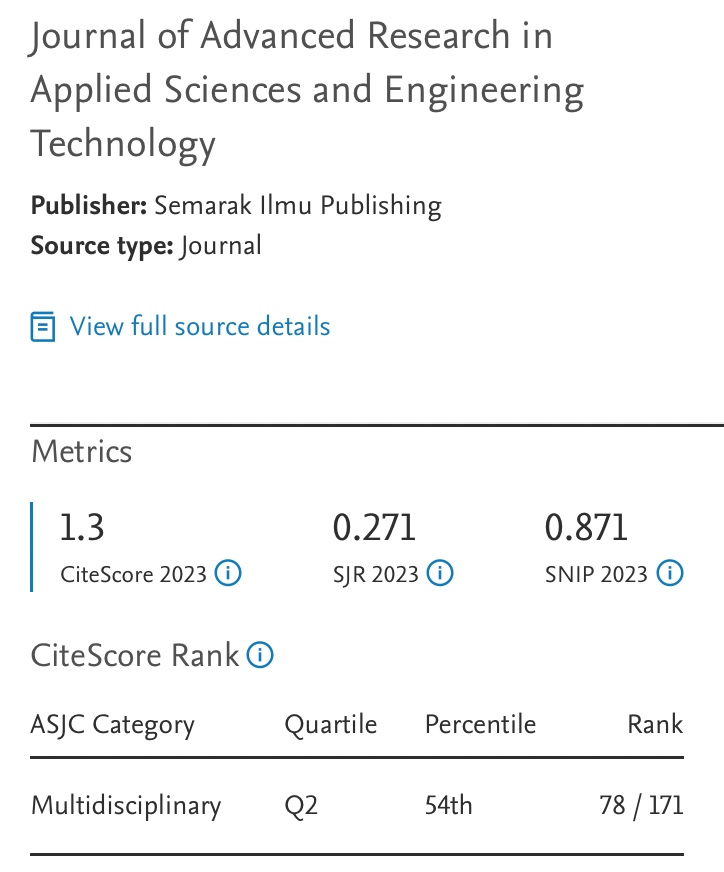

Evidence of Malaysian Company Performance using Copula and Stochastic Frontier Analysis During the COVID-19 Pandemic

DOI:

https://doi.org/10.37934/araset.33.1.256266Keywords:

Efficiency, performance, Stochastic Frontier Analysis and CopulaAbstract

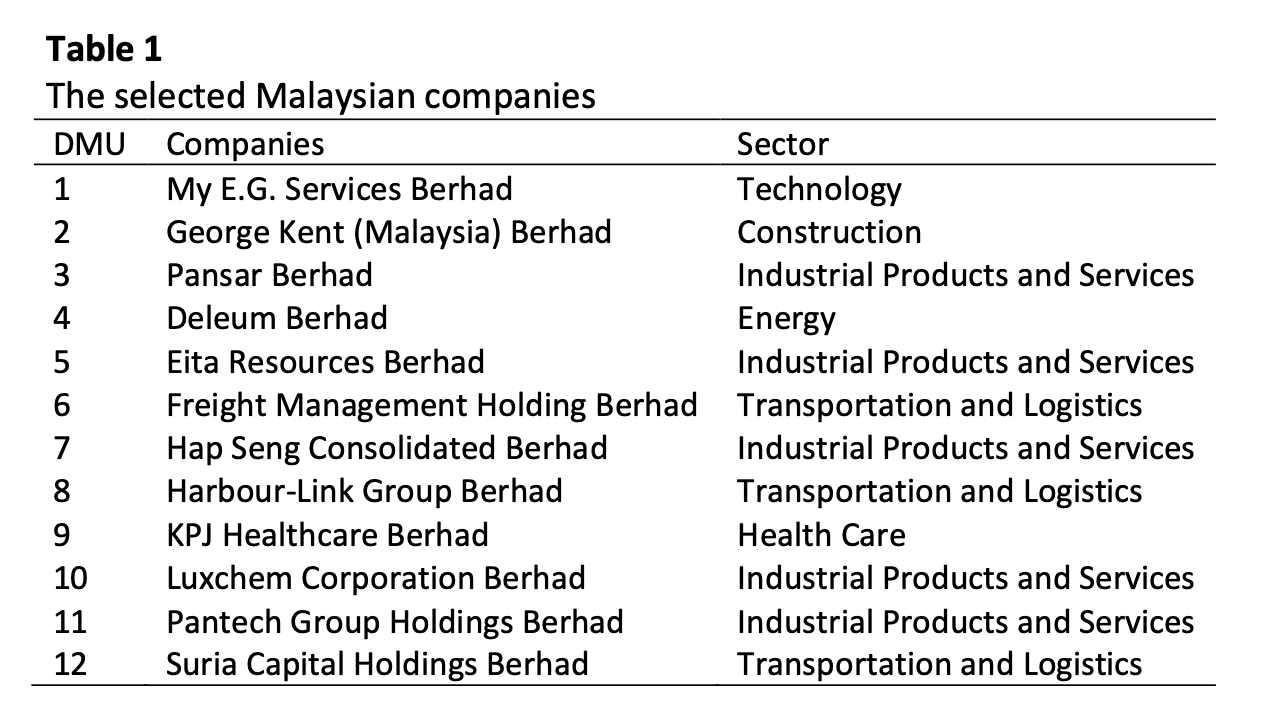

Traditional stochastic frontier analysis (SFA) assumes error independence, potentially leading to estimation and efficiency score errors. The purpose of this paper is to introduce the assumption of dependent errors into SFA to rank the performance of 12 Malaysian companies. In 2019 and 2020, during the global COVID-19 outbreak, the shockwaves it sent through various sectors, including healthcare and transportation, were profound. This study assesses company efficiency performance using the copula stochastic frontier analysis (CSFA) model. Seven Archimedean copulas are considered, and the most suitable copula is selected based on the lowest AIC (Akaike Information Criterion) value. The Cot copula, with an AIC value of -19.707, emerges as the best model. The results also reveal a relationship between random errors and inefficiency errors, as well as evidence that COVID-19 contributes to business inefficiency. According to the Cot copula results, Eita Resources Berhad (0.995), My E.G. Services Berhad (0.994), and KPJ Healthcare Berhad (0.857) are the top-performing companies, while Pansar Berhad (0.316), Suria Capital Holdings Berhad (0.319), and Hap Seng Consolidated Berhad (0.411) are the least efficient ones. Therefore, the primary contribution of this study is the proposition that the Cot copula and SFA are appropriate models for analyzing efficiency results. CSFA is a highly accurate model as it accounts for external factors, or random noise, in efficiency estimation and acknowledges the assumption of dependent errors in SFA, making it more realistic for real-world applications.

Downloads