The Development of a Deep Learning Model for Predicting Stock Prices

DOI:

https://doi.org/10.37934/araset.31.3.208219Keywords:

Stock price, Sentiment Analysis, Deep learning, BiLSTMAbstract

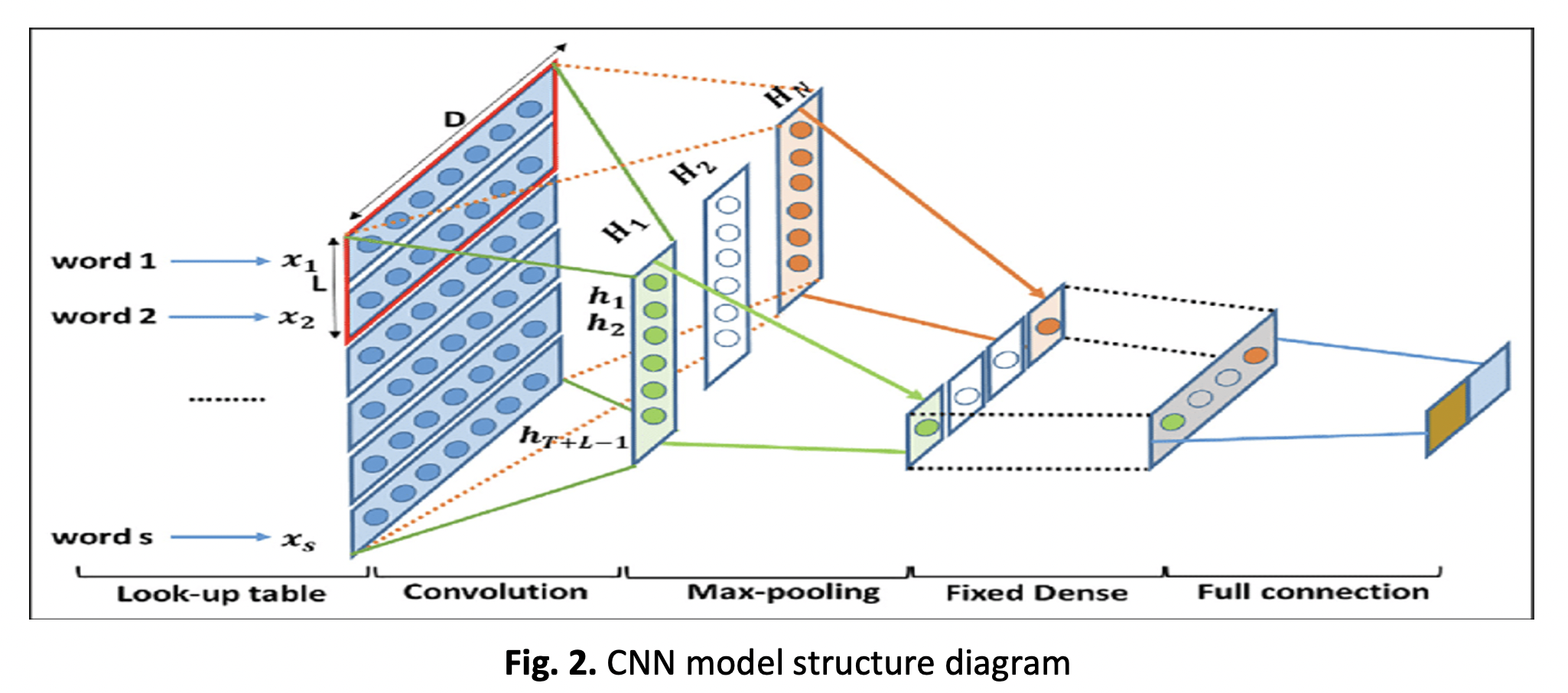

The volatility and complexity of the stock market make it difficult to predict stock values accurately. The primary goal of this paper is to overcome some of these difficulties by training the data to anticipate stock prices based on sentiment analysis of tweets. Using natural language processing (NLP) technology, the tweet sentiments were categorized into (positive - neutral - negative). The stock price was predicted using deep learning algorithms (CNNs, RNNs, LSTMs, BiLSTMs). Among the algorithms, (BiLSTM) achieved the best results in terms of accuracy (94%) and the others (CNN=90%, RNN=91%, LSTM=92%). The paper also confirms that the average MSE and RMSE (MSE=0.03552, RMSE=0.1882064) for the BiLSTM algorithm are achieved (MSE=0.03552, RMSE=0.1882064). As a result, the obtained results were better than previous studies.Downloads

Download data is not yet available.

Downloads

Published

2023-08-14

Issue

Section

Articles