Logistic Regression Model for Evaluating Performance of Construction, Technology and Property-Based Companies in Malaysia

DOI:

https://doi.org/10.37934/araset.39.2.7285Keywords:

Financial distress, Construction, Technology, Property, Financial ratio, Altman model, Springate model, Grover model, Zmijerski model, Logistic regression, AccuracyAbstract

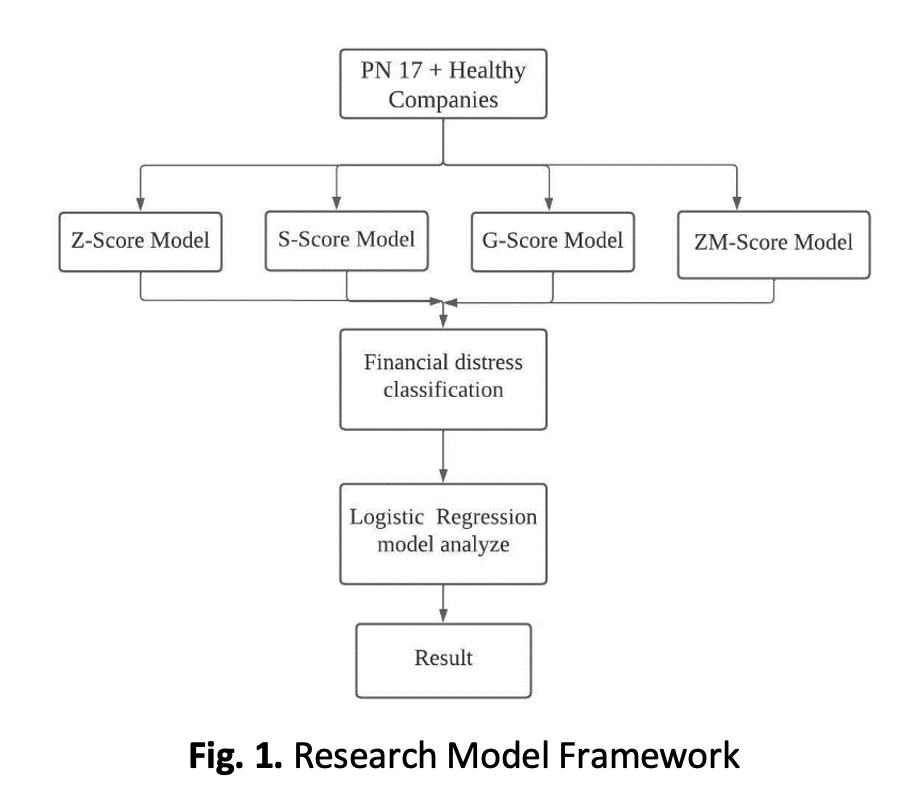

Financial distress refers to a situation where a company is facing significant financial difficulties or is at risk of insolvency. Being able to anticipate financial distress can help companies take proactive measures to address underlying problems, improve their financial health, and avoid bankruptcy. Likewise, investors can use such predictions to make informed decisions about their investments. The aim is to examine the significant factors of financial distress and accuracy model that can be effectively used in practice to analyse the financial distress of a construction, technology, and property-based companies. In this study, the Altman, Springate, Grover and Zmijerski model is used to classify the financial distress among construction, technology, and property-based companies in Bursa Malaysia Market Exchange during the 2017 to 2021. The models employ the logistic regression method to predict multiple financial ratios simultaneously to assess a company’s financial distress. The result shows that the most significant financial ratio for Altman Z-Score model is X1, and X4 followed by Springate model are X1, X5 and X6 and lastly, Zmijewski are ROA and DR. It also found that 100% accuracy of the Grover model suggested method has an acceptable efficiency to predict financial distress followed by Altman, Springate and Zmijewski model.

Downloads