Digital Payment Transactions: Islamic Finance Perspective

DOI:

https://doi.org/10.37934/araset.36.2.1220Keywords:

Payment technology, Digital payment, Islamic finance (shariah), Payment Islamic finance, Contract (akad), Payment technology (paytech), Fintech, Muamalat contracts, Online payment transactions, Unclear contracts, Parties involved, Security, New technology, Shariah principlesAbstract

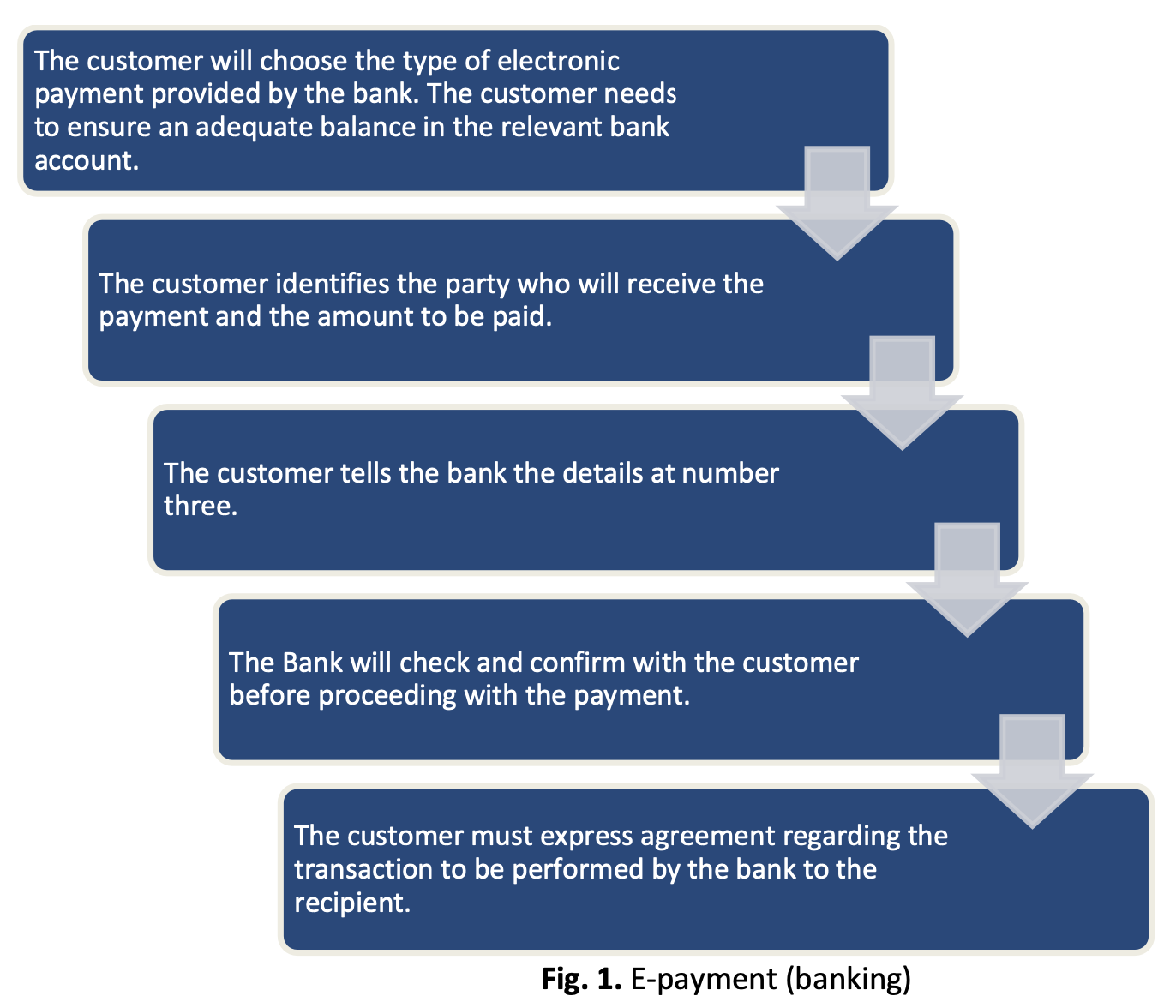

This paper provides an in-depth analysis of the implementation of Islamic finance contract (akad) in digital payment and Payment Technology (PayTech) transactions. With the rise of FinTech, digital payment has become a crucial component of the financial industry. However, implementing muamalat contracts in PayTech poses challenges related to unclear contracts, the relationship between parties, and security. The primary objective of this study is to identify the various types of online payment transactions and suggest alternative solutions to the Shariah issues that arise. To achieve this, the study adopts a qualitative methodology, which involves conducting library research and interviews with e-payment providers. The findings of the study shed light on several factors concerning Shariah issues and differences in the implementation of e-payment products and contracts. The paper aims to address the gap in previous literature by providing comprehensive insights into the implementation of Shariah-compliant PayTech transactions. The study recognizes the importance of refining the modus operandi of payment transactions when using new technology and ensuring compliance with Shariah principles in Islamic finance and banking. By doing so, the study contributes to the development of the Islamic finance industry, which is currently experiencing a surge in demand for Shariah-compliant financial products and services.