Autoregressive Integrated Moving Average (ARIMA) Algorithm Adaptation for Business Financial Forecasting

DOI:

https://doi.org/10.37934/araset.38.1.3747Keywords:

Financial Forecasting, Financial Ratio, Dutch Lady, Autoregressive Integrated Moving AverageAbstract

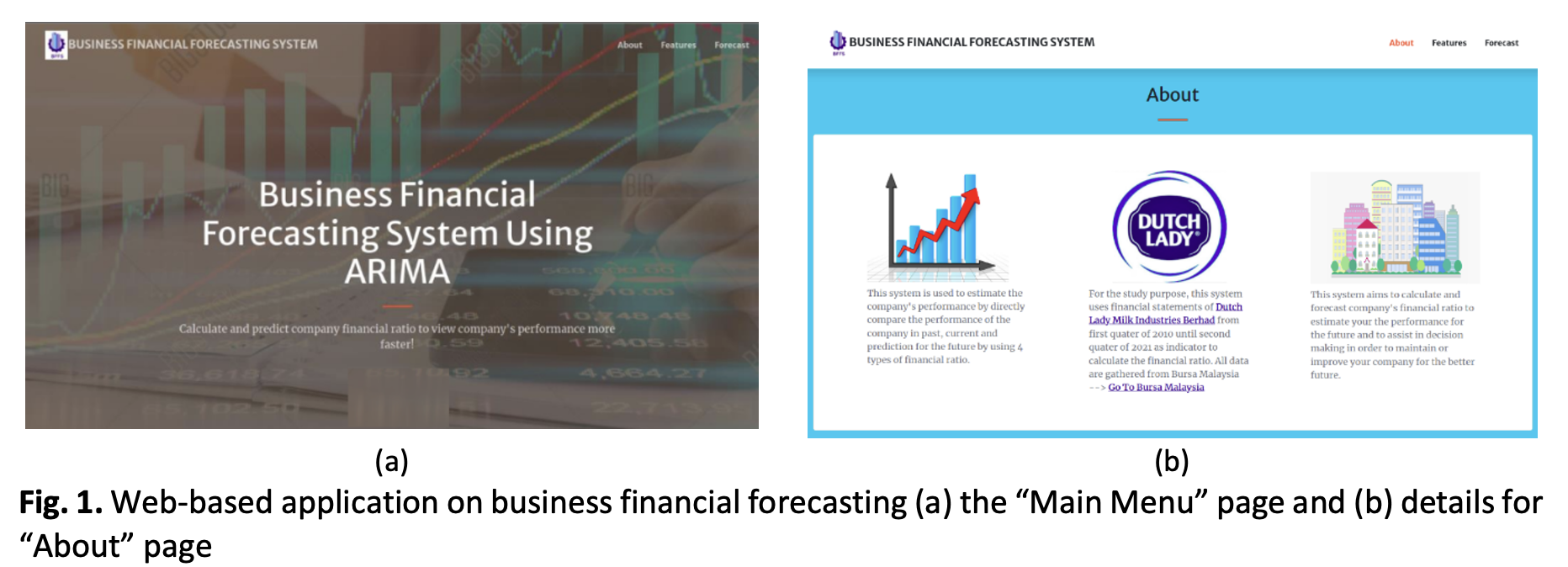

Financial management is the key to running a successful business, and financial forecasting is crucial to every business. Companies face difficulties making the right decision regarding their goals as they experience uncertainties in ensuring business growth. This study uses Dutch Lady company as a case study to help identify the company’s performance based on eight financial ratios and visualize the results using the visualization technique. Hence, the autoregressive integrated moving average (ARIMA) algorithm and visualization techniques were applied to overcome the problems. The data is obtained from the last quarterly report for the study purpose. There are 14 variables collected and used to calculate the eight financial ratios. The predictive modelling uses the ARIMA algorithm, and the models were evaluated using two types of error metrics: 1) mean absolute error (MAE) and 2) root mean squared error (RMSE). The reliability testing for the system’s prediction model shows a result p-value<0.05, and functionality testing successfully met the aims. The error metric evaluation result shows no significant differences between the forecast and actual values. The models can appropriately predict and forecast the financial ratio as the rules for both MAE and RMSE are fulfilled. The forecast results of each financial ratio are visualized and presented through the web-based system.

Downloads