Techno-Economic Assessment of Wind Energy in Urban Environments: A Case Study in Pattaya, Thailand

DOI:

https://doi.org/10.37934/arfmts.104.1.169184Keywords:

Levelized Cost of Electricity (LCOE), Net Present Value (NPV), Benefit Cost ratio (BCR or B/C ratio), Payback Period (PBP), Internal Rate of Return (IRR), carbon dioxide (CO2) emissions, WAsP, ThailandAbstract

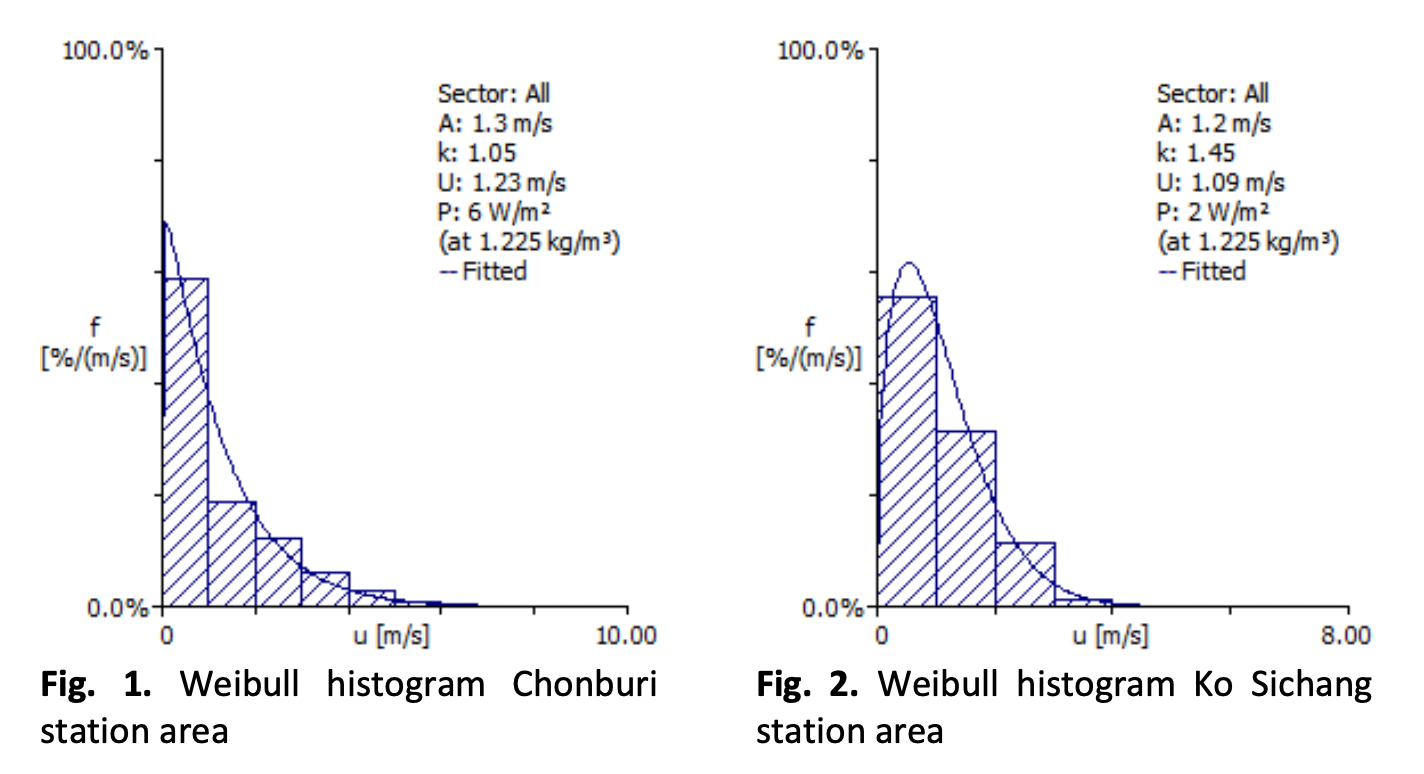

The goal of reducing carbon dioxide (CO2) emissions is a global collective challenge for the clean energy group, and it is reflected in Thailand's Renewable Energy Development Plan (AEDP) in 2018, which includes wind power as one of the six clean energy sectors. This study analysed the wind energy potential in Pattaya City, Bang Lamung District, Chonburi Province, in the Eastern Economic Corridor (EEC) Development Zone Plan, by utilizing data from weather stations and the Meteorological Department during the period of 2019-2021 at a height of 10 meters above the ground, comparing the areas of Pattaya Station, Chonburi Station, and Kao Si Chang Station. For the possibility of wind turbines with default heights ranging from 60 to 90 meters, three models are available: Bonus 1.3 MW, SWT-1.3-62, and SWT-2.3-82, as per the research results. The wind resources were found to be of Wind Power Class 1, with poor resource potential, and the prevailing wind direction in the study area was identified as northeast and west in Ko Sichang, southeast in Pattaya, and southwest and west in Chonburi. The Pattaya Station area was deemed unsuitable for wind farm establishment due to its low-wind power potential, as indicated by an economic analysis (public sector). It is not recommended for private or business sectors as it may not generate attractive returns or may result in losses. Based on the observations, the wind turbine with the highest AEP may not be the best choice for investment returns. This was demonstrated through an analysis of the SWT-2.3-82 VS wind turbine on Kaya Sira Hill, Koh Sichang, which had a CO2 Emission Reduction capacity of 2,154.24 tons CO2/GWh and an AEP of 3.366 GWh. Despite this, the LOCE of this model was not the lowest among the three models, and the LCOE and NPV of the SWT-1.3-62 were higher than the SWT-2.3-82 VS at all discount rate values. Moreover, the IRR of the SWT-1.3-62 were lower than the others, indicating that higher investments do not always lead to better returns.

Downloads