The Inclusive Innovation of Blockchain in Securities Issuance: Reduced Inequalities of Investors

DOI:

https://doi.org/10.37934/araset.46.2.188212Keywords:

Blockchain, Securities, Transparency, Hyperledger, ICO, Issuance, Smart contract, Efficiency, Transaction, BSWI, Economic growth, Resilient infrastructure, Inclusive innovationAbstract

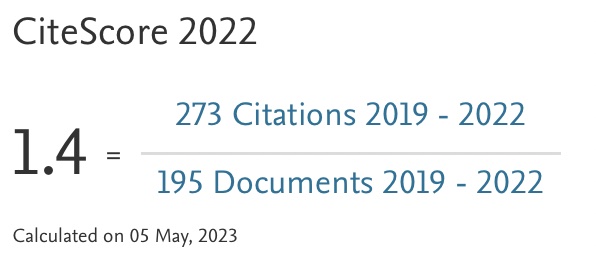

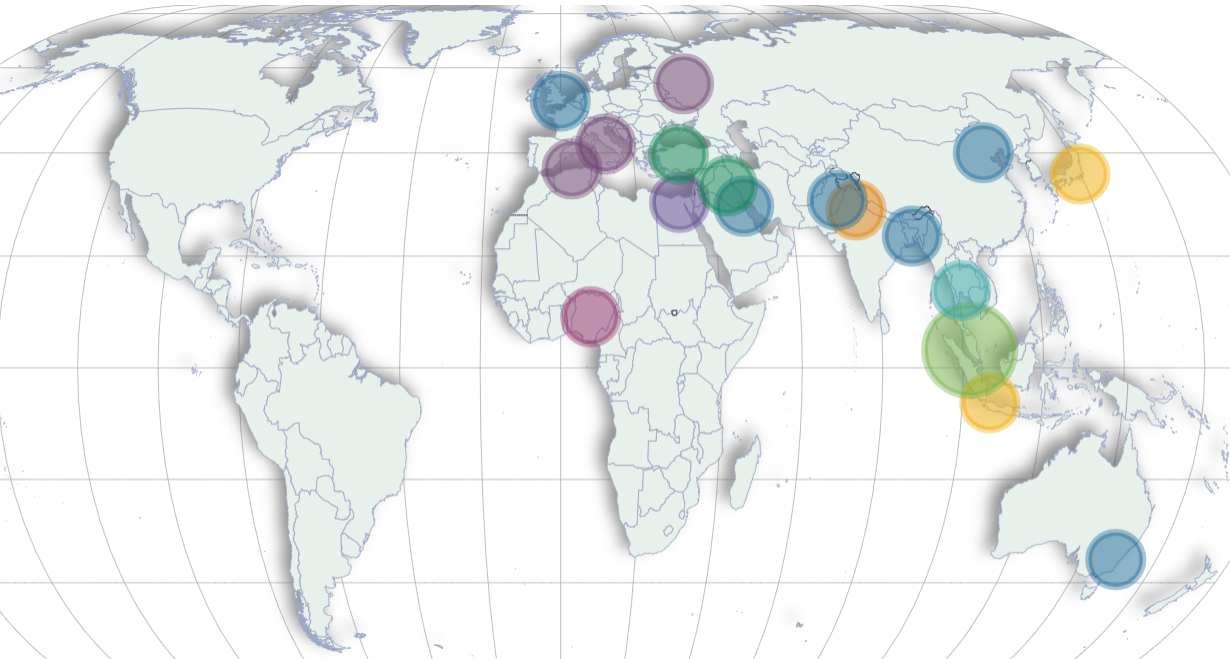

As an important driving force of financial technology, many financial institutions are exploring the application and scenario landing of blockchain. With the rise of the blockchain concept, the value of smart contracts is constantly being amplified and applied. Inefficient settlement, opaque asset issuance, and post-IPO regulation are the main obstacles facing securities markets in various countries. This research examines the application of blockchain in securities issuance. First, it reviews the current situation of the global and Chinese securities markets, analyses the existing problems and opportunities according to the existing processes, and focuses on the reliability of securities data, the transparency of securities issuance, and the application of smart contracts in securities trading. We also explore the regulatory hurdles and legal risks that blockchain-based securities may face and give recommendations accordingly. The mixed model method is chosen to make up for the limitations of various research methods. The collection of data is based on online questionnaires to collect people's opinions and attitudes toward these issues. Then the reliability and content validity of the data were verified. After confirming the valid data, the results of the data are analysed, the long-term effects and some recommended actions are discussed, and the hypotheses are validated based on the PLS-SEM model. Then, the paper proposes a scheme of blockchain securities based on weakened authority and looks forward to the future of blockchain securities. This research can provide theoretical guidance for the implementation of blockchain securities, and the proposed scheme solves the problem of transparency of securities and helps investors reduce losses caused by poor information. In the conclusion, we also analyse the practical challenges and considerations of implementing blockchain technology in the securities industry. Finally, intelligent transactions realized by blockchain securities can also reduce the economic and reputation losses caused by human errors for securities companies while reducing manpower costs.