Factor Analysis of Office Rent in the Kuala Lumpur City Centre Area

DOI:

https://doi.org/10.37934/araset.41.2.102112Keywords:

Machine learning, Crime prediction, Weather, Quality of LifeAbstract

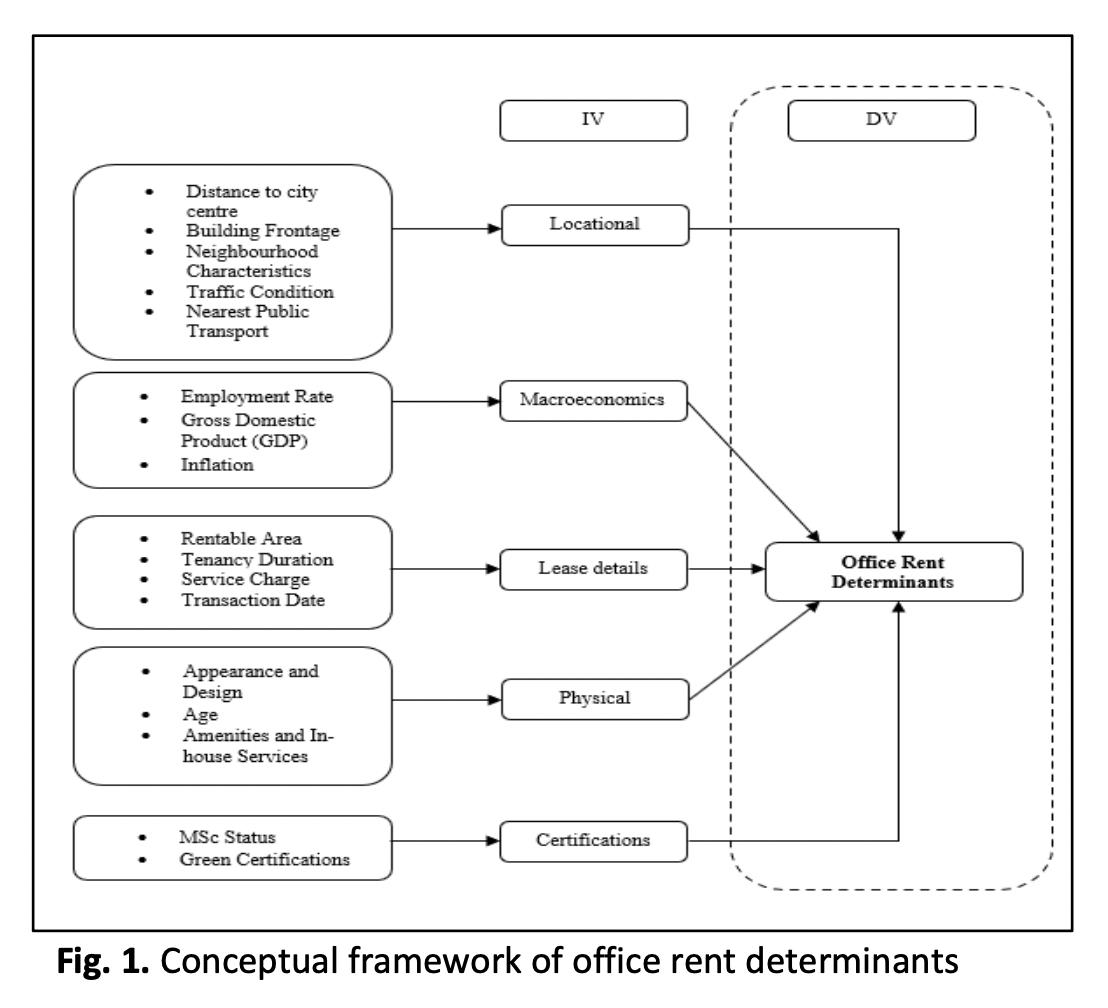

The office rental market often relates to good investment opportunities since it draws a lot of capital but comes with a substantial return. It somehow possessed a complicated market structure, and the heterogeneity of office buildings has become a challenge for investors and real estate practitioners to analyse office rentals data. This research seeks to analyse an office rental factor analysis based on data evidence from the Kuala Lumpur city centre, using two different approaches: Manual SPSS and AutoModel RapidMiner. Quantitative data, obtained through secondary data of office rental transactions, consist of a data set that includes 542 office rental transactions from 2015 to 2021. The results from the two different approaches were significantly related by studying the correlation value achieved through the AutoModel and Spearman rank correlation. The three determinants, namely green certificates, building appearance and design, and amenities and in-house services, can be identified as strong determinants. The research findings also provide support for the use of both manual and automated approaches in factor analysis and suggest that they can be used interchangeably to achieve similar results. This research allowed for a more comprehensive understanding of the office rental market in Kuala Lumpur, and provided real estate practitioners with useful insights into factors that influence office rental prices.