Analysis of Machine Learning in Classifying Bank Profitability with Corruption Factor

DOI:

https://doi.org/10.37934/araset.40.2.1321Keywords:

Machine Learning, Bank Profitability, Corruption, ClassificationAbstract

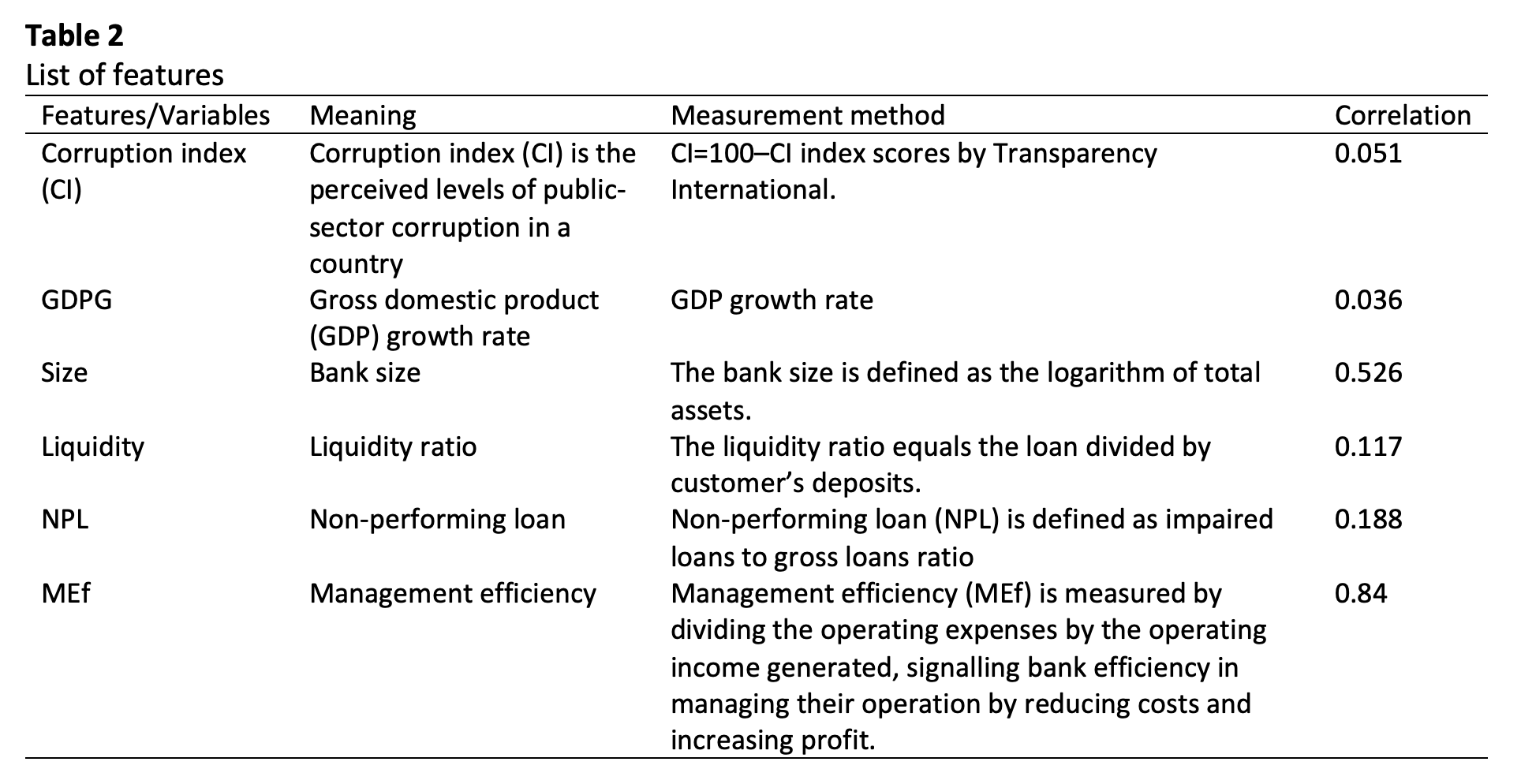

Corruption, which is generally defined as the abuse of authority for personal benefit, is not a recent phenomenon and has become a major issue in almost all countries throughout the world. Indeed, a high level of corruption increases bank non-performing loans which in turn reduces profitability and intensifies the fragility of the banking industry. Given the adverse impacts, corruption has been used as one of the factors in bank performance evaluation. As research on corruption-bank performance with machine learning techniques is rarely reported in the literature, this paper presents the empirical comparison of different machine learning algorithms for classifying bank profitability. Besides machine learning performance comparisons, this paper presents the analysis of machine learning features importance to justify the effect of corruption factor in the different machine learning algorithms for classifying bank profitability. The results indicated that all the tested machine learning algorithms present a good ability of classifying bank profitability at accuracy percentages above 70% but corruption index has contributed very minimal effect to the machine learning performances. The framework of this research is highly reproducible to be extended with a more in-depth analysis, particularly on the bank profitability factors as well as on the machine learning algorithms.

Downloads